Enterprise Zones

See if you qualify for Enterprise Zone advantages.

Cities and counties in Oregon have joined together to create enterprise zones to foster employment opportunities, development and local competitiveness.

The Enterprise Zone is a three-year or three- to five-year property tax abatement program. To qualify, an eligible firm must be making new investment in construction or equipment to leased or owned property within the Enterprise Zone boundary and must be creating new or additional jobs. Once an authorized company enters the program, it will receive full tax abatement on all qualified property during the time period, consecutively, as long as annual compliance with program requirements is met.

Eligibility

New companies to the area that are eligible for the program must create at least one new job, while existing companies must expand employment by at least 10 percent in the first year to be eligible. Non-qualifying employers include retail, commercial, most services, and other non-business-to-business operations. The total minimum investment required is $50,000.

Eligible investments are new real property improvements (including buildings), major site improvements, large or immobile equipment and tools. Non-qualifying investments include land, existing buildings, existing equipment, most rolling stock (forklifts, delivery trucks) and most personal property. There are no limits to the number of times a company may use the zone.

Incentives

Extended three-year exemptions, an extension of the standard three-year exemption, must be approved by the zone sponsor. To qualify, companies must pay an average of 150 percent of the average wage (covered employment payroll for all employers) in total compensation, which can include non-mandatory benefits such as vacation pay, medical insurance, bonuses, overtime, profit sharing and retirement contributions.

The Enterprise Zone offers traded-sector employers (companies that sell goods or services outside the local area and expand its economic base) and other eligible companies three- to five-year property tax exemptions on certain new capital investments that create jobs in the designated areas.

Information on Local Enterprise Zones

Many Linn-Benton communities participate in the Oregon Enterprise Zone program to encourage the creation of new industrial and manufacturing jobs in their communities. Qualified firms may obtain a three- year, 100 percent property tax exemption on new plants and equipment; an extended four- or five-year property tax exemption is available when additional local requirements are met. For additional information, please see the list of REAL Enterprise Zone contacts below.

For Enterprise Zones in Benton County, contact Kate Porsche.

For Enterprise Zones in Linn County, contact the individual cities listed below or for any other Linn County Zone questions refer to this map and contact John Pascone.

Harrisburg

For information, call 541.995.2200 or visit City of Harrisburg website for details.

To view the Enterprise Zone, click map.

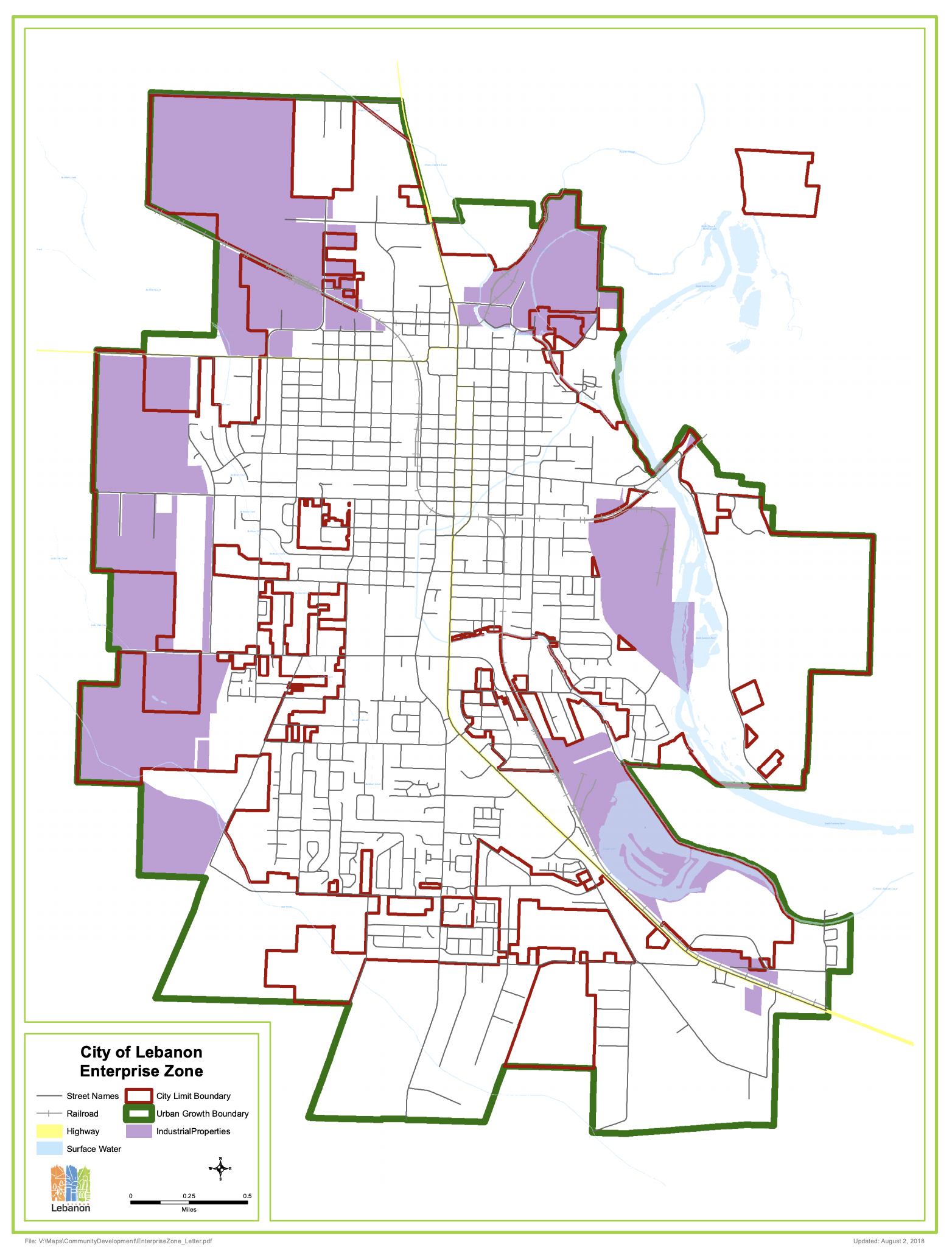

Lebanon

For information, call 541.258.4256 or visit City of Lebanon website for details.

To view the Enterprise Zone, click map.

Sweet Home

For information, call 541.818.8036 or visit City of Sweet Home website for details.

To view the Enterprise Zone, click map.

All Rights Reserved | Rural Economic Alliance